Apple is a lot lower in the ranks than you expect

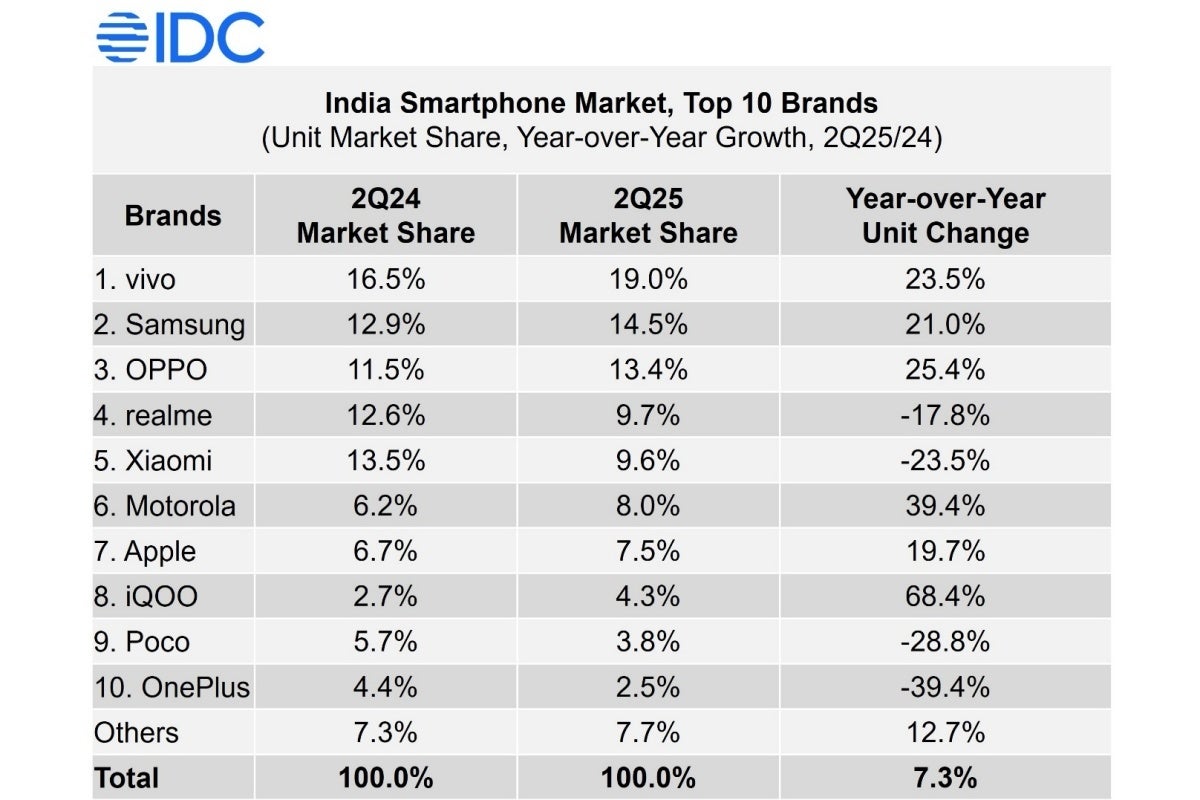

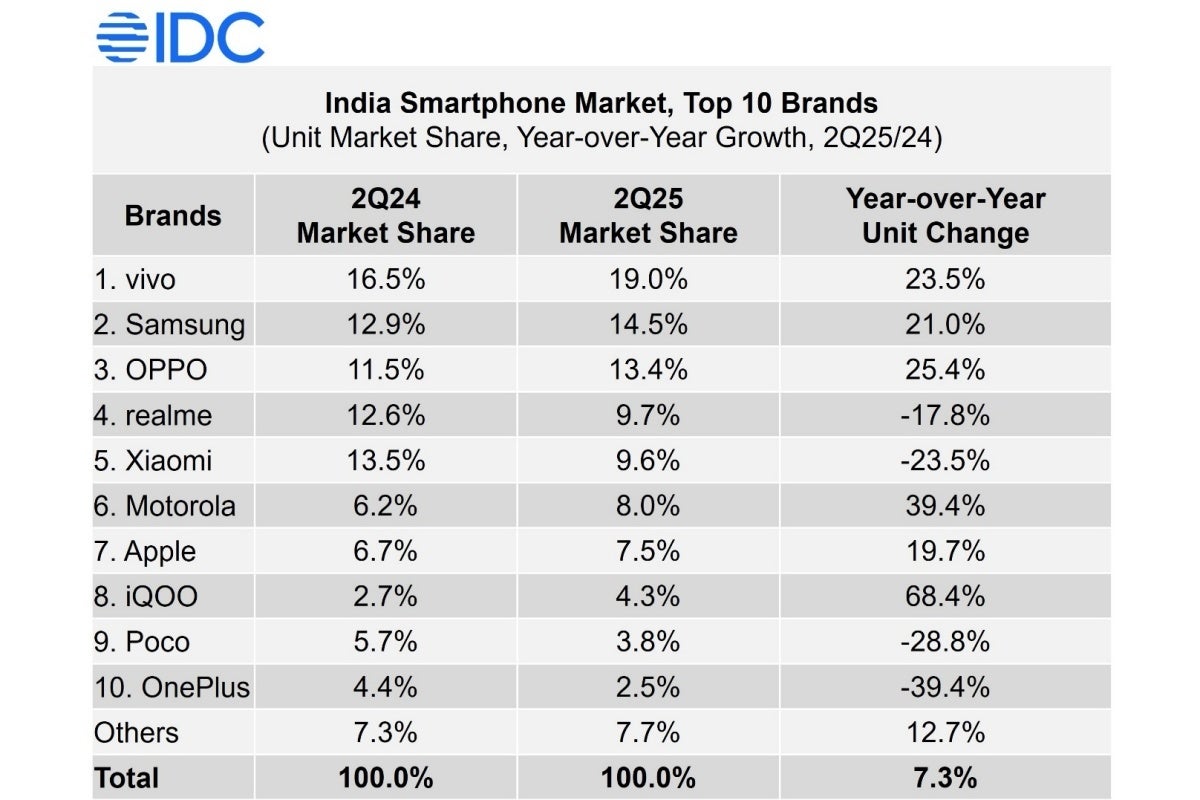

That’s right, the Cupertino-based tech giant is only India’s seventh-largest smartphone vendor as of the end of Q2 2025 despite boosting its market share from 6.7 percent during last year’s April-June quarter to 7.5 percent now and improving its sales numbers by a solid 19.7 percent year-on-year.

Vivo was number one in Q2 2024, and is still India’s top smartphone vendor.

OnePlus, mind you, registered the largest decline between its Q2 2024 and Q2 2025 shipment scores in India, at a painful 39.4 percent, followed by Poco and Xiaomi.

All in all, the IDC estimates that Q2 sales jumped by a healthy 7.3 percent from last year, but if you add the numbers from the previous quarter, you get a 70 million total for 2025’s first six months that’s only 0.9 percent larger than the market’s H1 2024 tally. Of course, any progress is better than no progress, but the country’s annual growth after a mediocre 2024 is expected to be “limited” by “subdued consumer demand” over the remainder of 2025.

Samsung gets the super-premium crown, while Apple has to settle for the premium title

What’s the difference between the “premium” and “super-premium” segments? A phone’s price, of course, with models available for anywhere between $600 and $800 falling in the former category and those costing more than $800 earning a place in the latter.

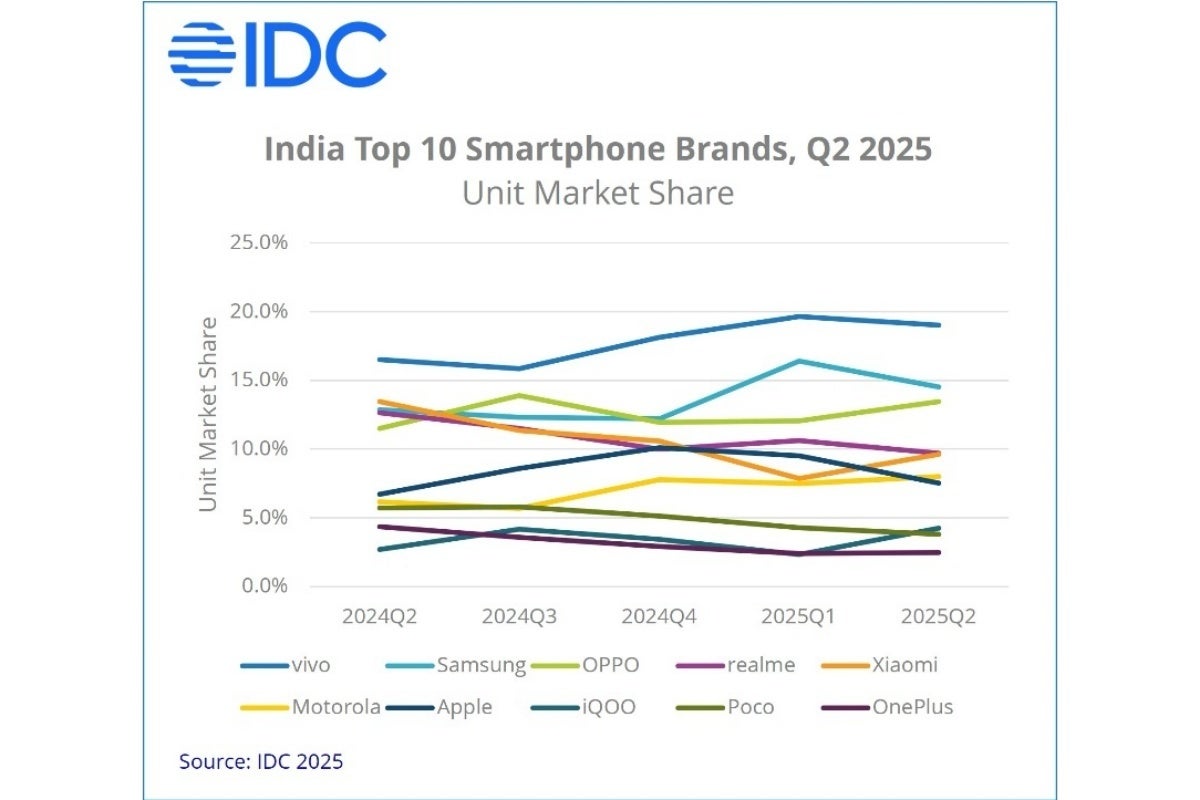

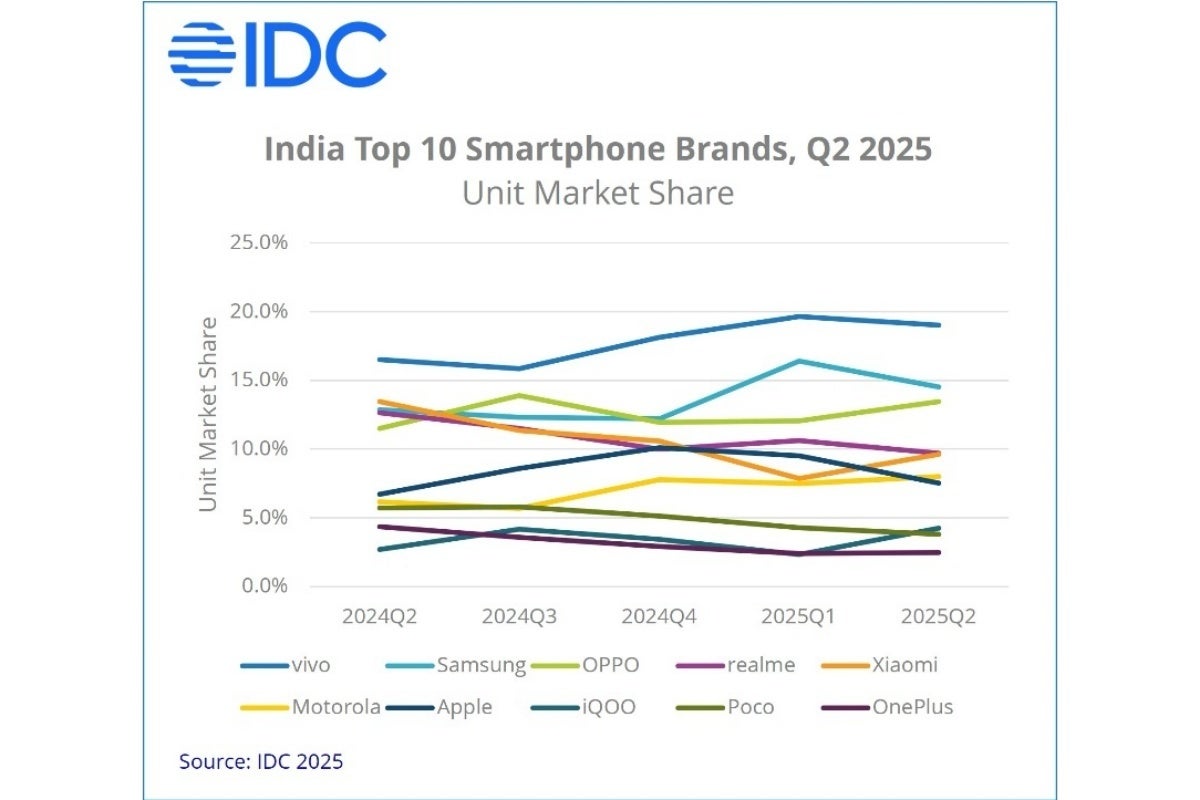

Those are some very interesting fluctuations for almost all major brands… apart from Vivo.

Of course, the “mass budget” and “entry-premium” segments remain easily the biggest of the bunch, at 42 and 27 percent shares respectively, and those categories are obviously not dominated by Apple. Instead, Vivo continues to sell the largest number of smartphones priced between $100 and $400 in India, followed by Oppo and Samsung. That explains Vivo’s overall market supremacy, as well as Apple’s inability to crack even the nation’s top five vendors group, let alone the top three.

#Samsung #beats #Apple #superpremium #throne #huge #smartphone #market