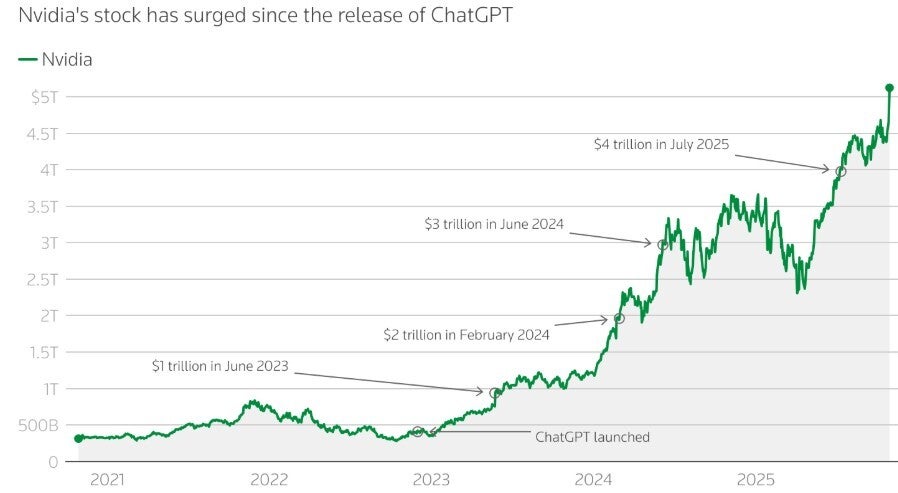

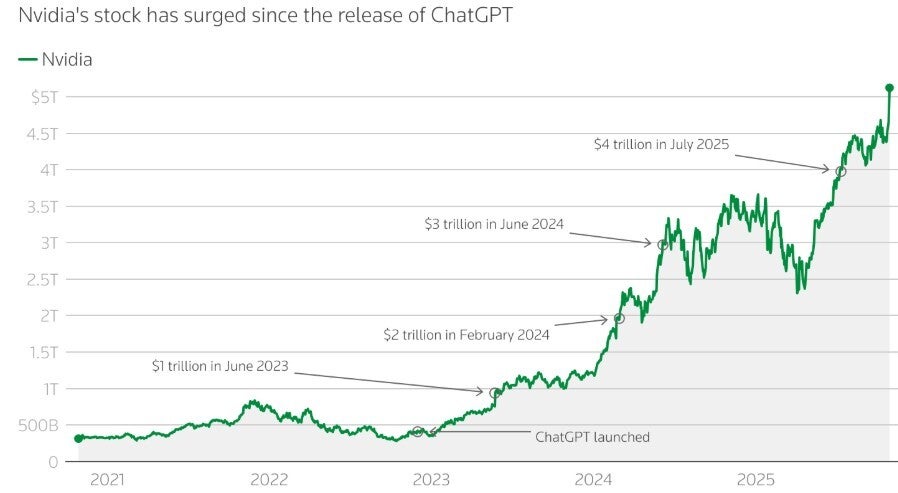

How Nvdia became the first U.S. publicly traded stock valued at $5 trillion

Stock market leadership changes over time as new innovations replace the older ones. With the iPhone soon to mark its 20th anniversary (it was first unveiled on January 9th, 2007), Apple has lost the title of the “One tech stock that needs to be in everyone’s portfolio.” There is nothing hotter in tech now than artificial intelligence (AI) and no stock is hotter than Nvidia. That’s because Nvidia’s graphic processing units (GPU) are the chips of choice for AI.

That’s because GPUs use parallel processing since they are equipped with thousands of smaller cores that process information simultaneously. GPUs can perform the matrix math needed to train AI models. Central processing units (CPU) process information sequentially making them less useful for AI use.

Nvidia’s road to a $5 trillion valuation” Image credit-LSEG

Nvidia’s GPUs are used to train AI models in large data centers. They are also used for AI inference which is the use of AI to make predictions or to generate content for real-time generative AI use in generative AI (chatbots, image generators, and coding assistants), self-driving vehicles, healthcare and robotics.

Like Apple before it, Nvidia remains the stock that every fund has to buy

Just to be more specific, Nvidia traded at $164.42 back in July compared to its current stock price of $207.42. Nvidia is now valued at 50% of Europe’s Stoxx 600 index made up of 600 top European equities. If Nvidia follows the experience of Apple’s shares, it could continue to rise as AI usage expands throughout the world. Eventually, portfolio managers controlling mutual funds and hedge funds, representing huge amounts of cash, say to themselves that they have to buy Nvidia so they can show fundholders that they have the hottest stock in their portfolio selling themselves as master stock pickers.

Soon, consumers start buying the stock for their own portfolios. The company is highlighted on the cover of every personal investment magazine as the one AI stock to buy. But this is a major warning sign. Everyone who wants the stock has bought it and the only buyers left are the ones who are late to the game and are about to get fleeced.

Co-founder and CEO Huang is the eighth richest person in the world

Matt Britzman, senior equity analyst at Hargreaves Lansdown, a Nvidia stockholder, told clients, “Nvidia hitting a $5 trillion market cap is more than a milestone; it’s a statement, as Nvidia has gone from chip maker to industry creator. The market continues to underestimate the scale of the opportunity, and Nvidia remains one of the best ways to play the AI theme.”

Thanks to the huge rise in the value of Nvidia, co-founder and CEO Jensen Huang is now worth $179.2 billion making him the eighth richest man in the world.

While Nvidia was the first to be valued at over $5 trillion, and is the top AI stock, both Apple and Microsoft have made it past $4 trillion and have AI connections of their own. Analysts say that the rally in AI-related companies is due to what investors view as continued spending on AI infrastructure which benefits Nvidia. Some analysts warn that the sector is overbought.

#proof #iPhone #yesterdays #news