So who’s the big winner here?

If you ask me, all three of the aforementioned brands deserve their laurels and all the glory corresponding with their respective regional titles.

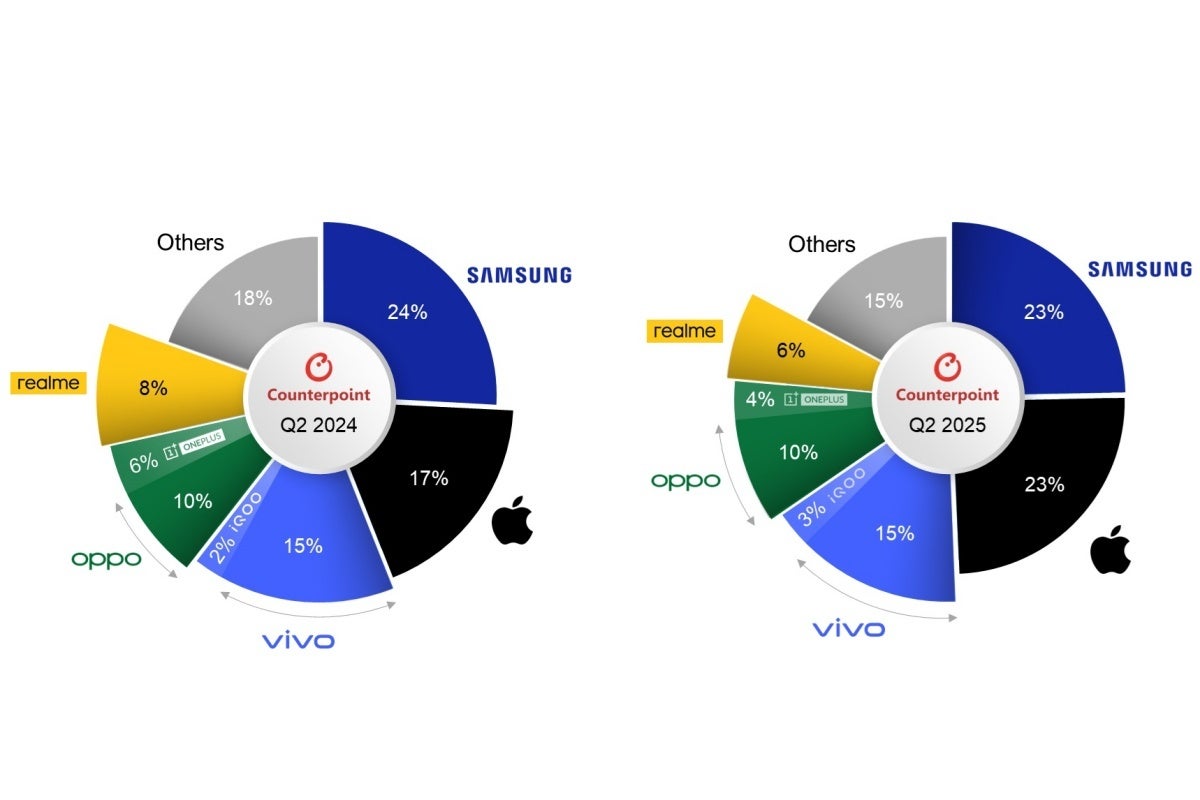

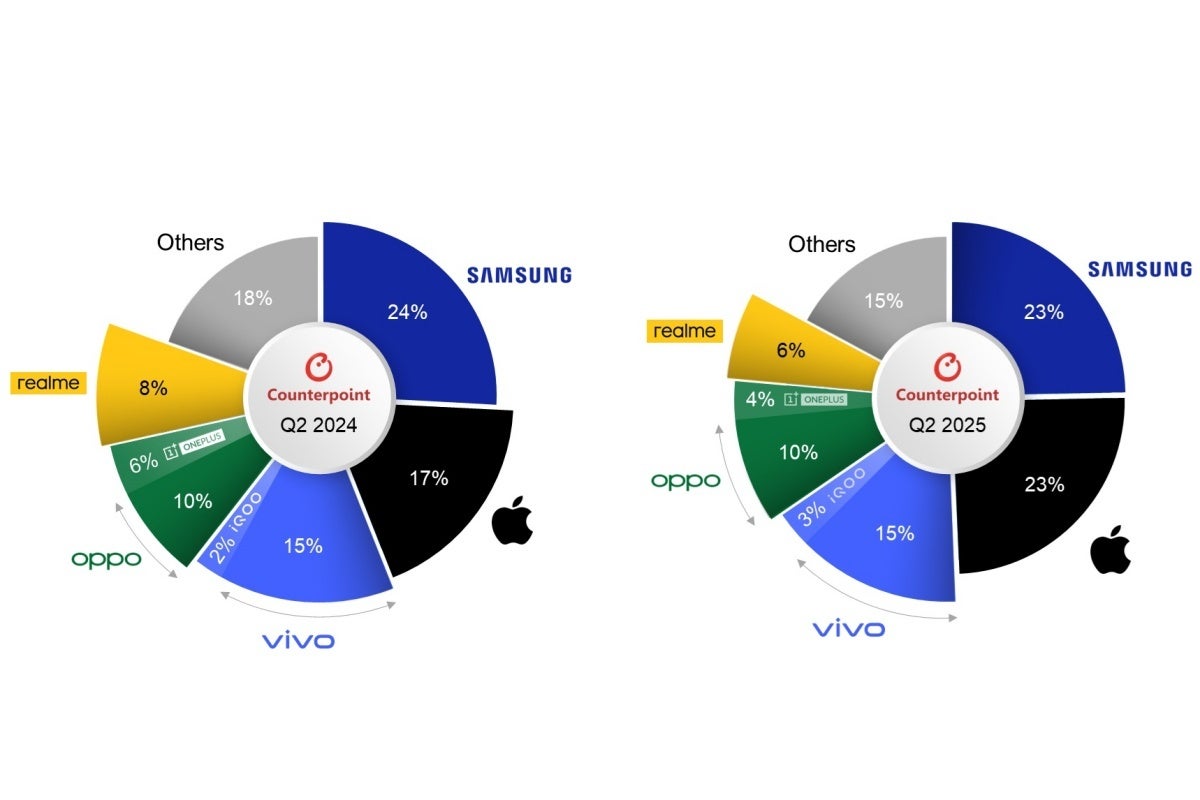

Apple is still nowhere to be found among India’s top five smartphone vendors. | Image Credit — Counterpoint Research

Other vendors deserve great praise too

I’m talking primarily about Nothing and Motorola, which may not be among India’s top five smartphone vendors, but are definitely likely to get there… eventually if they keep up their towering recent growth rates.

Vivo can’t be happy about Samsung and Apple’s advantage in this value chart. | Image Credit — Counterpoint Research

As for Motorola’s humbler but still phenomenal 86 percent year-on-year increase in Indian sales, that was apparently driven by both the Moto G and Edge families on the back of “expanded distribution and deeper retail penetration in smaller cities”, which sounds like two factors that will inevitably propel the Lenovo-owned brand to the country’s top five (or even top three) vendor group.

In the aforementioned “ultra-premium” division of India’s smartphone market, meanwhile, OnePlus remarkably managed to boost its shipments by 75 percent thanks to the company’s latest high-end models (compact 13s included), although that still wasn’t enough to push the brand’s volume share higher than 2 percent.

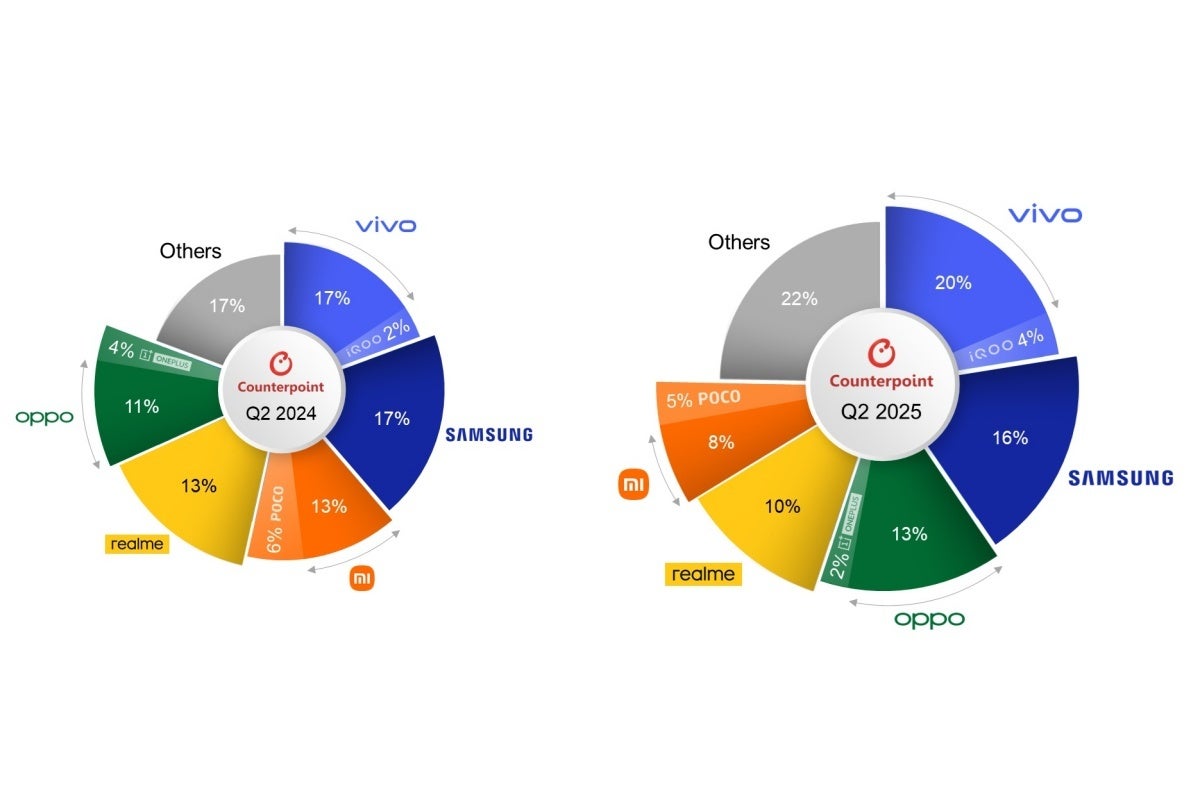

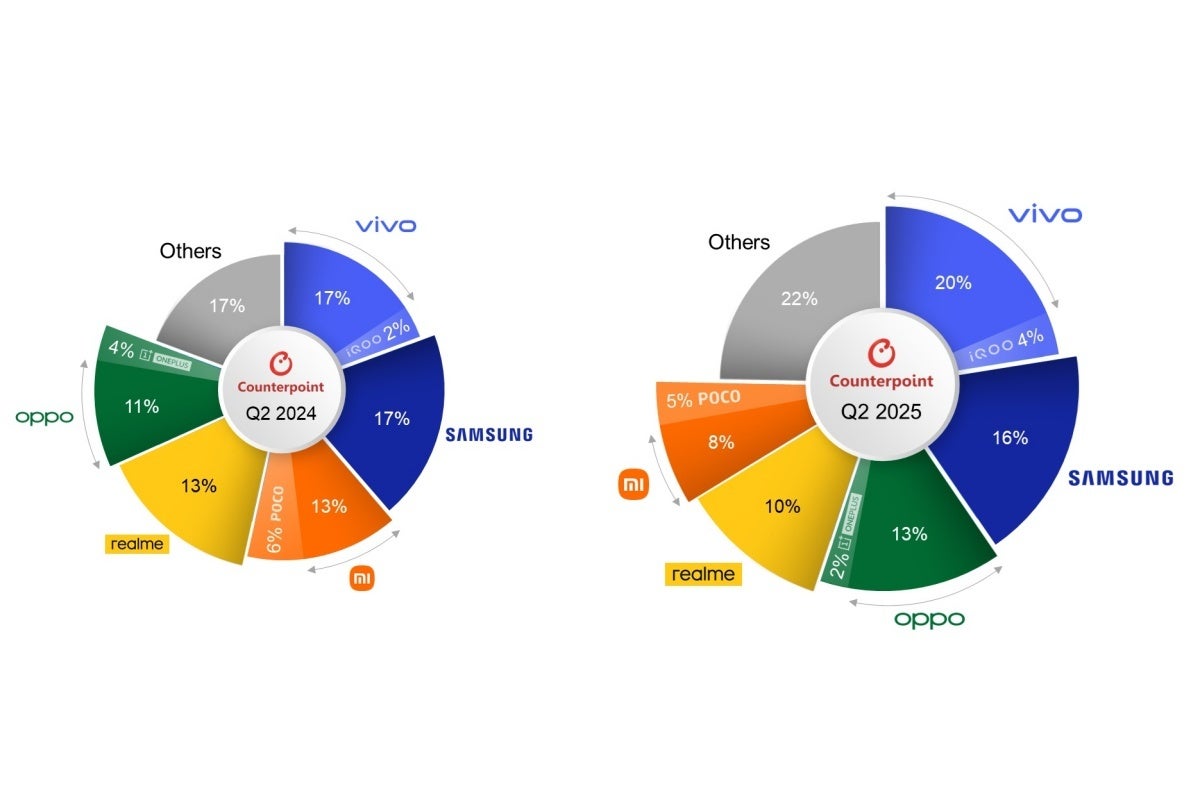

With or without its sister brand’s numbers, Oppo ranked third in volume in Q2 2025, behind Vivo and Samsung but ahead of Realme, Xiaomi, or Poco, not to mention Apple, Motorola, and Nothing. All in all, sales went up in India by 8 percent compared to last year’s second quarter, while the market’s wholesale value absolutely exploded, gaining 18 percent in the same period of time.

#iPhone #leads #major #sales #chart #Samsung #claims #bigger #win #Apple