Samsung’s beleaguered foundry unit made a surprise announcement in South Korea Monday morning local time. The foundry announced that it would supply automobile manufacturer Tesla with chips until 2033. The transaction is valued at $16.5 billion and is huge for Samsung Foundry, which has been a distant second to TSMC in the business of contract chip manufacturing.

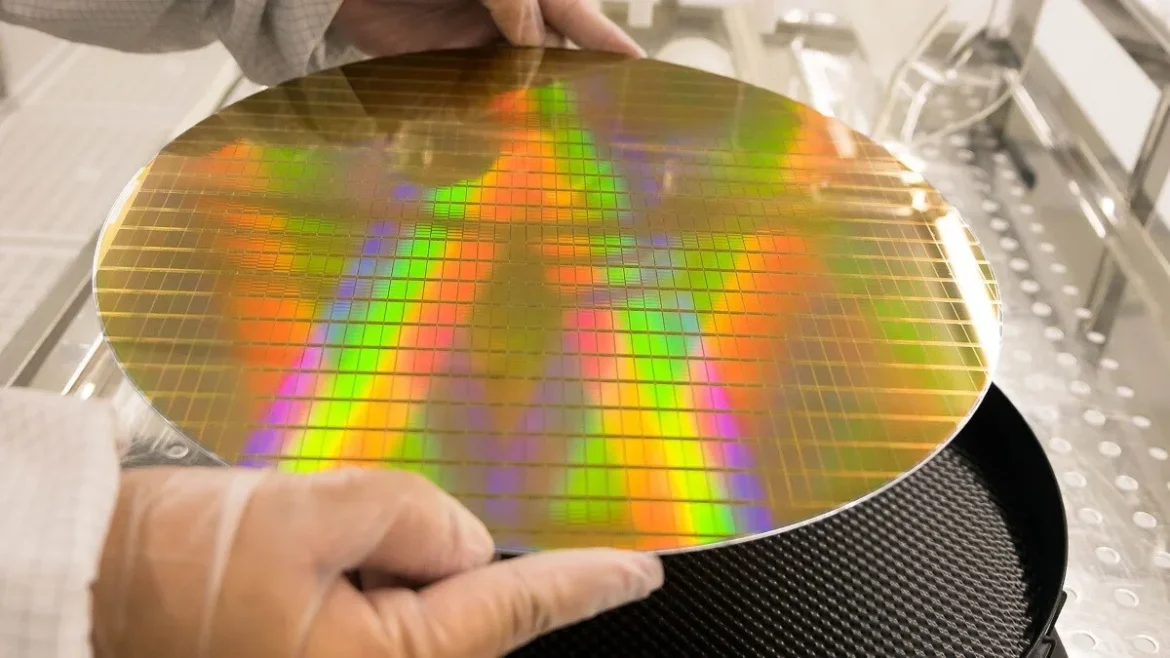

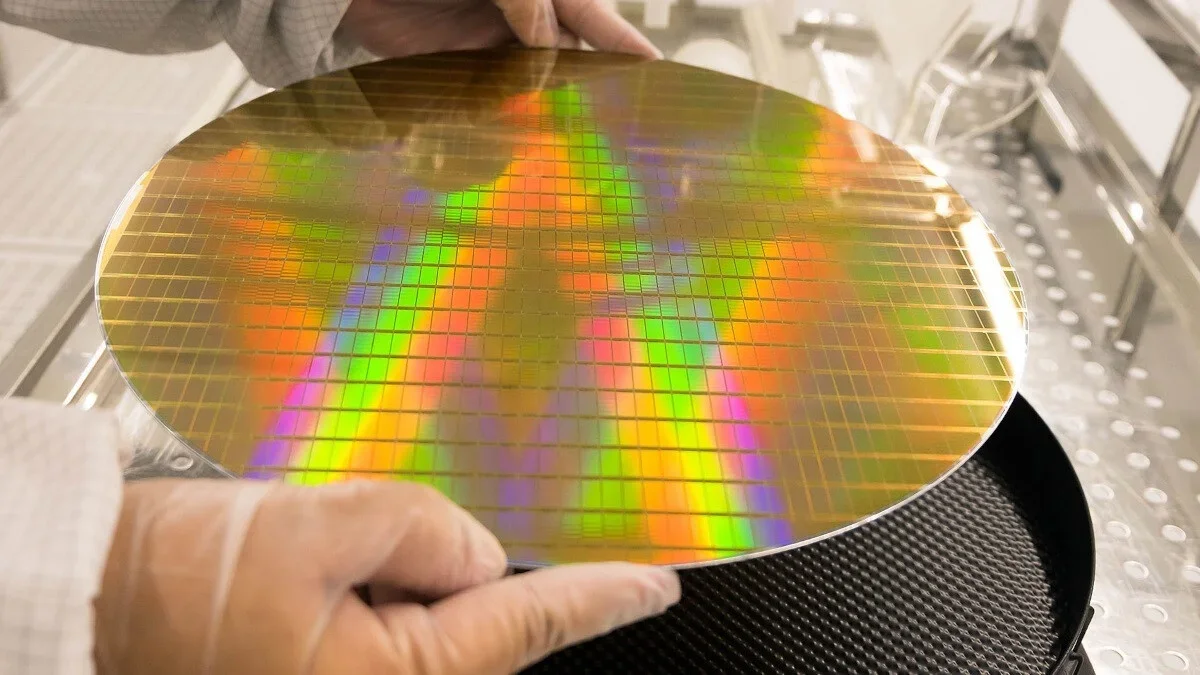

Samsung Foundry’s yields have been well below TSMC’s. This measures the percentage of dies cut from a silicon wafer that pass quality control (QC), divided by the maximum number of usable dies that the wafer could have produced. A low percentage means that not enough good chips are being manufactured, and that results in higher prices for the chips that can be used. The yield issue has cost Samsung Foundry business from big-name chip designers such as Qualcomm.

TSMC had a leading 67.6% share of the contract chip manufacturing business in Q1. Samsung Foundry was second with a 7.7% share. The deal with Tesla could help generate more business for Samsung Foundry. Finding new clients and keeping current ones has been difficult for the Samsung unit. Kiwoom Securities analyst Pak Yuak says the deal will reduce the red ink that Samsung’s foundry business has been spilling. For the first half of this year, Samsung Foundry lost more than 5 trillion won ($3.63 billion).

Investors seem pleased by this announcement as Samsung’s shares soared 6.8% on Monday, rising 4,500 Korean won ($3.45) to 70,400 Korean won ($50.68). The feeling is that with this order, Samsung Foundry may have turned a corner in a bid to become more competitive with TSMC.

#huge #billion #order #mark #start #turnaround #Samsung #Foundry